Beginning with the new year, Tammy Boring of Snyder & Company will provide administrative support to CPA Network Ohio, including event and CPE planning, membership inquiries and sharing resources with the group.

Member firms and their staff were provided a two-day A&A update on September 20-21 in a hybrid format. Nearly forty were provided more than 16 hours of CPE either in-person or online. Those in-person spent additional time networking while at Maumee Bay Lodge & Conference Center near Toledo.

Special thanks to our two amazing instructors, Tom Groskopf from the Center for Plain English Accounting and Michael Cheng with Frazier & Deeter who brought the most technical of topics to everyone.

We want to congratulate our favorite A&A educator, Tom Groskopf on being named to Accounting Today’s list of the Top 100 Most Influential People in Accounting. This honor recognizes Tom’s leadership of the Center for Plain English Accounting, a key program of the American Institute of Certified Public Accountants. During his tenure at CPEA, Tom has traveled the country to more than 150 CPA firms to explain in “Plain English” difficult technical accounting and auditing standards including the new Revenue and Lease Accounting standards. Tom’s work at CPEA has helped over 30,000 accounting and audit professionals.

“I’m honored by this recognition and humbled by the accomplishments of the others on this list,” Tom noted. I congratulate my fellow honorees and I thank Accounting Today for including me on this list.”

”The business environment today is more complicated than ever. This includes massive technological change, globalization, standards/regulation change, political instability, and tight labor markets,” Tom added, “I look forward to continuing to assist the clients of Barnes, Dennig and CPEA member firms in navigating these challenges.

Tom’s past service on the Private Company Council, representative of the United States on the International Financial Reporting Standards’ Small- and Medium-sized Entity Implementation Group and the Private Company Financial Reporting Committee underscore why he was named to the Top 100 List.

You can read more on the press release from Tom’s firm, Barnes Dennig, HERE.

We had a wonderful Tax Update this year. This year we were back with Bradley Burnett and Embassy Suites Dublin after a bit of a break from both. The remodel by the hotel was lovely, and Brad’s humor helped keep us all engaged as we hit some of the stickiest codes we will be facing this tax season.

Registration is now open for all of our 2019 events. You can see the information and access registration forms on the events page. This year we have a hard stop on the number of seats for both the A&A Seminar and Tax Update. Please don’t wait too long to sign up. You don’t want to miss out on these great sessions.

Here are some photos from 2018 A&A and 2018 Tax Update:

We had a full two days of reviewing our annual survey, strategic planning and a team-building event at Breakout Dayton. Be prepared to hear more as we build on three key initiatives chosen to be our focus for the next year!

CHOICE-OF-ENTITY DECISIONS UNDER THE NEW TAX ACT

Bradley T. Borden

Business owners and their tax advisors are working to figure out how the 2017 Tax Cuts and Jobs Act will affect business owners’ after-tax bottom line and whether business owners should change their entity structure to reduce their taxes. In particular, the changes to the corporate tax rate and the new deduction for passthrough entities may affect the choice-of-entity calculus, and some business owners will wonder if they should change the type of entity they currently use. This brief article considers a few different scenarios to show how the new corporate tax rate and new passthrough deduction may affect the tax liability of small business owners, including services professionals such as attorneys. The article illustrates that generalities may not apply to the choice-of-entity decision in the same manner that they did under the former law. It also shows the new rules add a layer of complexity to the analysis.

The new corporate tax rate is 21%. That rate applies to a corporation’s taxable income, but corporate dividends are also subject to tax. For individuals, dividends are taxed at 0%, 15%, or 20%, depending upon the recipient’s tax situation (the 20% rate applies when a jointly-filing married couple’s income exceeds $479,000). The new act also creates a deduction for qualified business income (QBI), which applies to income from a qualified trade or business (QTB), which will include many LLCs, partnerships, S corporations, and sole proprietorships. The QBI deduction is 20% of QBI, subject to limits based upon the W-2 wages and assets of the QTB.

Posted: December 30, 2022 by CPA Network

CPA Network Ohio Welcomes New Administrator in 2023

Beginning with the new year, Tammy Boring of Snyder & Company will provide administrative support to CPA Network Ohio, including event and CPE planning, membership inquiries and sharing resources with the group.

Tammy can can reached at (740) 654-9989.

Last Updated: September 21, 2021 by CPA Network

2021 A&A Update a Success

Member firms and their staff were provided a two-day A&A update on September 20-21 in a hybrid format. Nearly forty were provided more than 16 hours of CPE either in-person or online. Those in-person spent additional time networking while at Maumee Bay Lodge & Conference Center near Toledo.

Special thanks to our two amazing instructors, Tom Groskopf from the Center for Plain English Accounting and Michael Cheng with Frazier & Deeter who brought the most technical of topics to everyone.

Posted: December 20, 2019 by CPA Network

CPA Network Congratulates Tom Groskopf

We want to congratulate our favorite A&A educator, Tom Groskopf on being named to Accounting Today’s list of the Top 100 Most Influential People in Accounting. This honor recognizes Tom’s leadership of the Center for Plain English Accounting, a key program of the American Institute of Certified Public Accountants. During his tenure at CPEA, Tom has traveled the country to more than 150 CPA firms to explain in “Plain English” difficult technical accounting and auditing standards including the new Revenue and Lease Accounting standards. Tom’s work at CPEA has helped over 30,000 accounting and audit professionals.

“I’m honored by this recognition and humbled by the accomplishments of the others on this list,” Tom noted. I congratulate my fellow honorees and I thank Accounting Today for including me on this list.”

”The business environment today is more complicated than ever. This includes massive technological change, globalization, standards/regulation change, political instability, and tight labor markets,” Tom added, “I look forward to continuing to assist the clients of Barnes, Dennig and CPEA member firms in navigating these challenges.

Tom’s past service on the Private Company Council, representative of the United States on the International Financial Reporting Standards’ Small- and Medium-sized Entity Implementation Group and the Private Company Financial Reporting Committee underscore why he was named to the Top 100 List.

You can read more on the press release from Tom’s firm, Barnes Dennig, HERE.

Posted: November 15, 2019 by CPA Network

Throw Nation!

Some of the tax seminar attendees gathered up and went to test their skills throwing axes at Throw Nation! A great time was had by all.

Posted: November 15, 2019 by CPA Network

Success at the 2019 Tax Update

We had a wonderful Tax Update this year. This year we were back with Bradley Burnett and Embassy Suites Dublin after a bit of a break from both. The remodel by the hotel was lovely, and Brad’s humor helped keep us all engaged as we hit some of the stickiest codes we will be facing this tax season.

Posted: March 13, 2019 by CPA Network

Time to Register for 2019 Events!

Registration is now open for all of our 2019 events. You can see the information and access registration forms on the events page. This year we have a hard stop on the number of seats for both the A&A Seminar and Tax Update. Please don’t wait too long to sign up. You don’t want to miss out on these great sessions.

Here are some photos from 2018 A&A and 2018 Tax Update:

Posted: July 18, 2018 by CPA Network

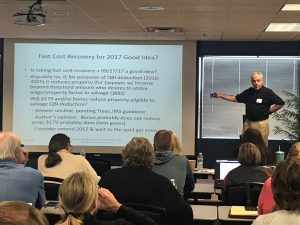

Great Turn-out for New Tax Act Seminar in Columbus

We had about 75 attendees at the July 12, 2018 seminar on the New Tax Act with speaker Bradley Burnett. It was a great session!

Posted: May 23, 2018 by CPA Network

May 2018 MAP Recap

We had a full two days of reviewing our annual survey, strategic planning and a team-building event at Breakout Dayton. Be prepared to hear more as we build on three key initiatives chosen to be our focus for the next year!

Last Updated: March 1, 2018 by CPA Network

Choice-of-Entity Decisions Under the New Tax Act

CHOICE-OF-ENTITY DECISIONS UNDER THE NEW TAX ACT

Bradley T. Borden

Business owners and their tax advisors are working to figure out how the 2017 Tax Cuts and Jobs Act will affect business owners’ after-tax bottom line and whether business owners should change their entity structure to reduce their taxes. In particular, the changes to the corporate tax rate and the new deduction for passthrough entities may affect the choice-of-entity calculus, and some business owners will wonder if they should change the type of entity they currently use. This brief article considers a few different scenarios to show how the new corporate tax rate and new passthrough deduction may affect the tax liability of small business owners, including services professionals such as attorneys. The article illustrates that generalities may not apply to the choice-of-entity decision in the same manner that they did under the former law. It also shows the new rules add a layer of complexity to the analysis.

The new corporate tax rate is 21%. That rate applies to a corporation’s taxable income, but corporate dividends are also subject to tax. For individuals, dividends are taxed at 0%, 15%, or 20%, depending upon the recipient’s tax situation (the 20% rate applies when a jointly-filing married couple’s income exceeds $479,000). The new act also creates a deduction for qualified business income (QBI), which applies to income from a qualified trade or business (QTB), which will include many LLCs, partnerships, S corporations, and sole proprietorships. The QBI deduction is 20% of QBI, subject to limits based upon the W-2 wages and assets of the QTB.

Read More

http://ssrn.com/abstract=3119829

Last Updated: January 25, 2018 by ddmartin

CPA Network Launches New Website

Be sure to check back for news, upcoming events and important updates.